We understand that running a business means you’ve got a seemingly endless list of things to get done. Why let accounting, bookkeeping, and tax rob you of your valuable time that you’d rather spend concentrating on the core aspects of your business or spending time with your family?

Avery Martin Accountants is here to help!

We understand that at the heart of every successful business is a solid framework and accounting best practices. Our team of accountants and tax experts can help you stay close to your numbers and make sense of your financial data so you can make wiser business decisions that will maximize your profitability and manage your risks. With our reliable accounting and bookkeeping services, you will also be able to get a better view of your overall business performance and identify where you need to improve.

Staying compliant with the constantly changing tax laws and regulations is vital in securing your business’ future and avoiding problems with the law. However, by working with Avery Martin Accountants, you won’t have to worry about understanding the complexities of these tax matters. We won’t only help with the timely preparation and filing of your tax returns, but we can also get involved with your tax planning so you’ll get the maximum deductions with our legal tax reduction strategies.

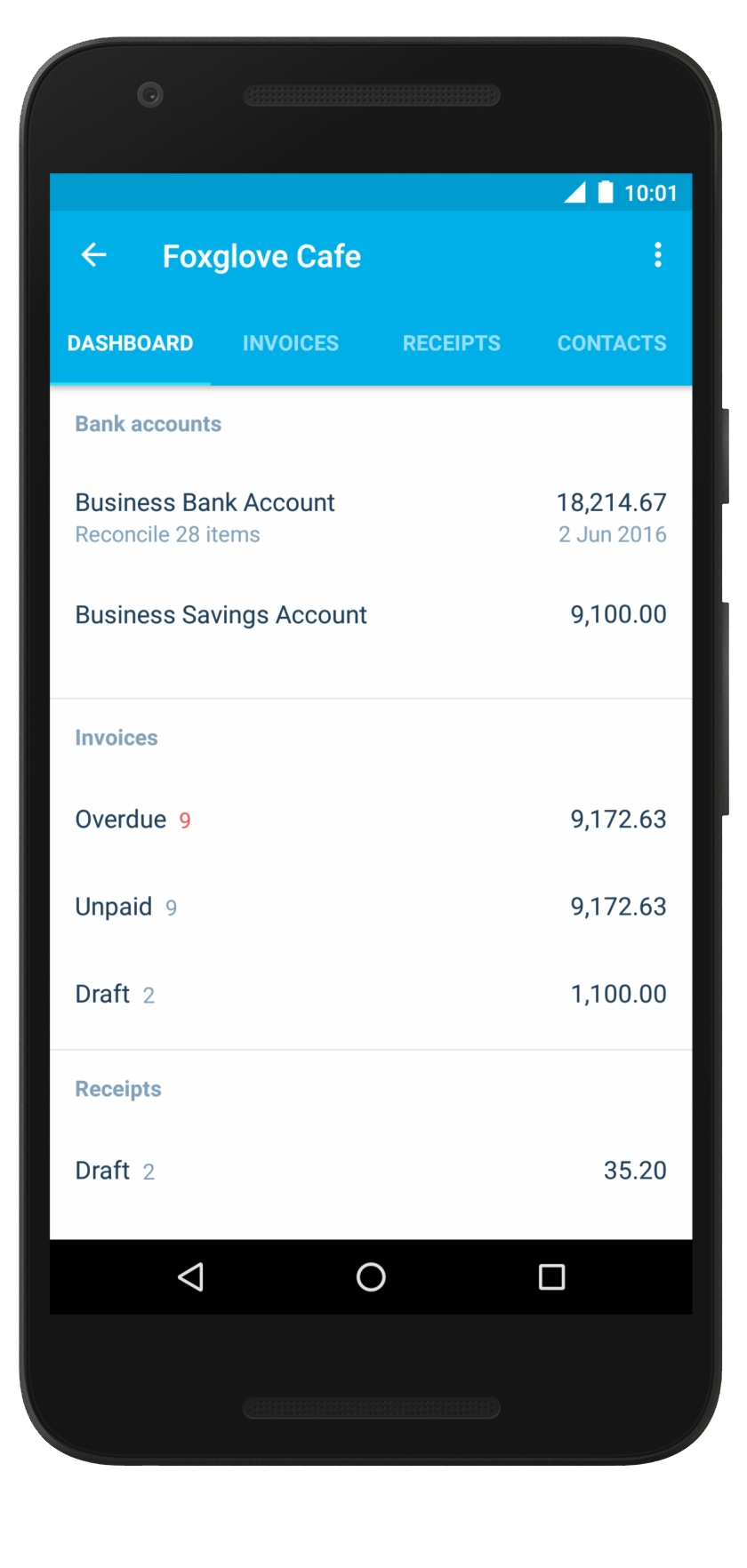

At Avery Martin Accountants, we embrace technology as the best way to adapt to the increasingly competitive business environment. By partnering with leading cloud-based accounting software providers such as Xero, we bring our clients the latest tools and solutions that will make collaboration smoother and get your accounting done faster and easier. Furthermore, by having your updated financial data and reports easily accessible, you will be able to generate financial insights anytime and anywhere, as well as make decisions faster.