We’d like to draw your attention to a Tax Relief and a New Tax Consultant.

Our new Tax Consultant Tim helps guide small business owners, to secure the maximum cash in their business from government research, development and innovation incentives, empowering them to survive and thrive.

As a business we want to make sure all our business owner clients understand whether their business activities qualify for R&D Tax Relief.

You see, qualifying businesses can claim back costs incurred 3 years ago. If you make profits, you can claim an immediate refund of corporation tax. If you are loss making, HMRC will pay you a cash credit of 33% of the amount you have spent.

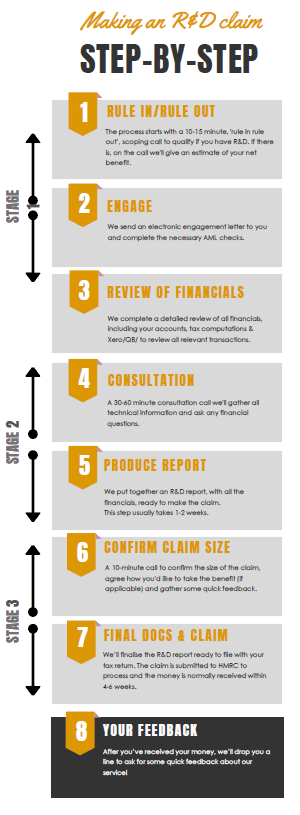

Through asking the right questions, we’ll be able to determine for you in a 15-minute conversation whether you are eligible to make a claim.

We are easy to work with, the process for you is painless and we will deliver you the maximum cash back into your business.

If you’d like to find out if your businesses could be eligible for R&D Tax Relief, book your 15-minute call here, you’ve got nothing to lose.

Sign up now and we’ll get you up to speed with Xero – simple and intuitive cloud accounting software.

Book your free no-obligation consultation and find out how we can help your business!

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |